Do you have a lack of consistent security policy and PCI-DSS compliance enforcement across different environments e.g. public, private, multi-cloud, as well as network platforms and infrastructure devices e.g. multi-vendor firewalls, routers, SDN environments, etc.

Operationalize traditionally manual network security tasks to minimize the risk of data breaches and free up resources to pursue advanced cybersecurity strategies:

“Tufin has enabled us to achieve continuous compliance with PCI-DSS for our Cisco and Check Point firewalls, and to cut audit prep time in half.”

-IT Manager, Monext

The Payment Card Industry (PCI) Data Security Standard (DSS) is one of the most wide-reaching standards since it applies to any organization processing payment card transactions and receiving credit card payments.

Whether safeguarding cardholder data is an integral part of the core business – as in online retail and financial services – or an important aspect of the core business (such as internal purchasing departments, consumer payments for services provided in the public and private sector), ensuring network access controls are in compliance with PCI DSS standards is essential.

Automating network security policy eliminates manual processes, minimizes misconfiguration risk and ensures network changes are based on security policy to prevent your cardholder data environment from being expose to untrusted networks and unauthorized access.

One obstacle to maintaining PCI-DSS compliance is the manual nature of network security policy management and configuration of security-policy-based network access controls across devices and cloud resources.

Many organizations struggle to maintain a secure network and protect sensitive data, because they have internal network firewalls from multiple vendors and are using multiple cloud platforms, which creates a great deal of complexity, fragmentation of processes and gaps in visibility.

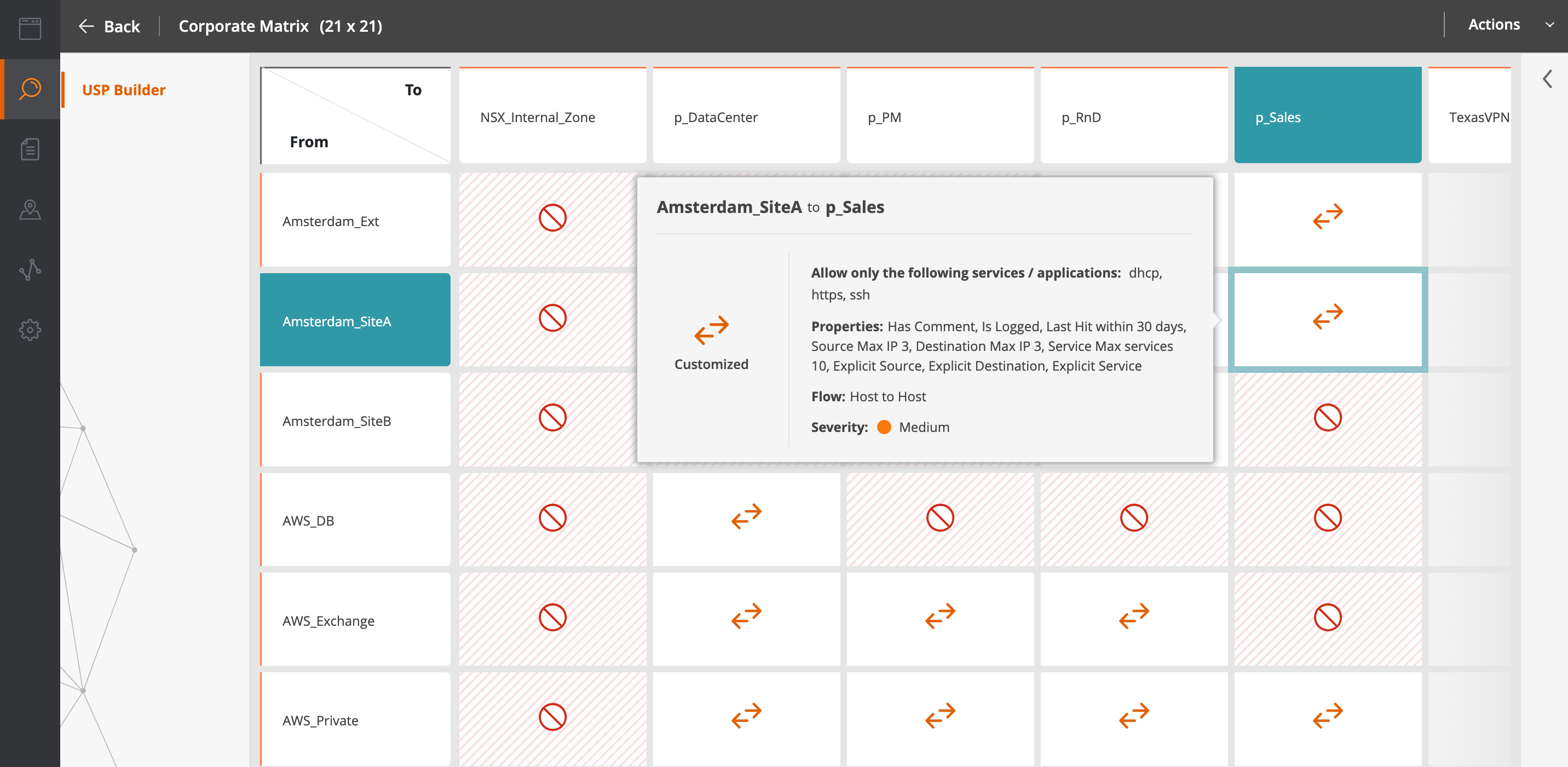

Tufin abstracts that complexity, establishes a holistic view of your internal network and cloud environments, and it provides a simple interface through which to design and manage advanced network security segmentation strategies. From a single interface you can manage who can talk to whom and what can talk to what, ensuring least-privilege access to your cardholder data environment.

Download the PCI-DSS Compliance Solution Brief

“Ensure audit readiness with custom compliance reports for rule usage and documentation.”

-Senior Manager Security Operations, Top 10 Global Consumer Bank

Management PCI-compliant firewall rules and cloud requirements from a single interface.

Information security personnel, along with PCI internal auditors, must perform periodic audits every six months. It is not feasible for network security teams to manually integrate the new policies, the management and testing required for compliance, while maintaining business-as-usual.

Because Tufin centralizes security policy management across these devices and resources, it provides a single source for your network access change tracking, compliance monitoring and audit reporting. Tufin customers have virtually eliminated manual audit prep tasks and reduce the time spent on audit tasks by 70% or more.

“Our engineers are spending less time on repetitive, error-prone manual tasks – and our firewalls are in line with our corporate security policies.”

-Manager of Security Architecture

In addition, Tufin enables PCI-DSS compliance by automating firewall rule and cloud connectivity change design, impact and risk assessment and provisioning. This can include checking vulnerability scan data for the source and destination to determine whether they have vulnerabilities prior to allowing a change, reducing opportunities for hackers to access your cardholder data.

Automating the change process with a built-in risk assessment will dramatically reduce the risk of data breaches by preventing human error and exposure of payment card data to vulnerable assets. Throughout the firewall change process, Tufin is logging an immutable audit trail.

Traditional firewalls, next-generation firewalls, routers and cloud-native enforcement points — have rulesets comprised of hundreds or thousands of rules.

Tufin makes it easy to identify and remove unused and shadowed rules, and it helps you minimize risky rulesets by automatically checking rulesets against historic network traffic logs to achieve a least-privilege state, based on actual business need. This make it much easier to ensure you’re adhere to PCI-DSS firewall requirement that inbound and outbound traffic to payment systems should be restricted to only what is necessary.

Tufin’s automatic cleanup and intelligent policy generation functionality reduces opportunities for unauthorized access through tighter firewall configuration and improves firewall performance.

Tufin makes it easy to see what rules are applied across your entire hybrid network, which adhere to or violate your PCI compliant security policy and view an audit trail of access control changes and approvals.

A manual firewall audit process can take weeks. Tufin’s firewall audit tools cuts your audit preparation down to days or hours through automation and always-on audit logging that provides full documentation of change management processes.

Respond to audit requests in real time via a single console that allows you to easily demonstrate that you’re meeting firewall requirements with prebuilt and customizable reports for standards and regulatory mandates, such as PCI DSS, HIPAA, SOX, NERC CIP and more.

Tufin’s software generates security audit reports on demand proving that you’re pci compliant.

A single, central console monitors for violations against your PCI-DSS network access policies and demonstrates your continuous compliance across firewalls and routers, SDN and hybrid, multi-cloud environments. Reports can be easily automated, based on criteria, such as business area, firewall vendors, cloud service providers, time periods, and geographic regions.

Customers have cut their audit prep time from weeks to 2 hours by turning to Tufin to eliminate manual tasks.

PCI-DSS stands for Payment Card Industry Data Security Standard. Any organization processing payment transactions or holding payment card data strives to comply with this standard. Although it isn’t a law, it can apply to merchants in various ways. For example, it can be part of a contractual agreement between a merchant and card company. Also, states may write PCI DSS language into state law. You can find additional information and courses at pcisecuritystandards.org

There are 12 requirements:

Gain end-to-end visibility, automate policy management, and mitigate risks across your global hybrid network – from traditional enterprise firewall infrastructure to modern cloud CI/CD pipelines – without impacting speed or agility.

Only Tufin provides automation and a unified security policy, from on-prem to cloud, across NetSec and DevOps.